SIBUR’s experts from the Investment Planning and Investor Relations Department talk about the causes and implications of the economic crisis driven by soaring prices of feedstock, energy, and durable goods.

Prices continue to rise

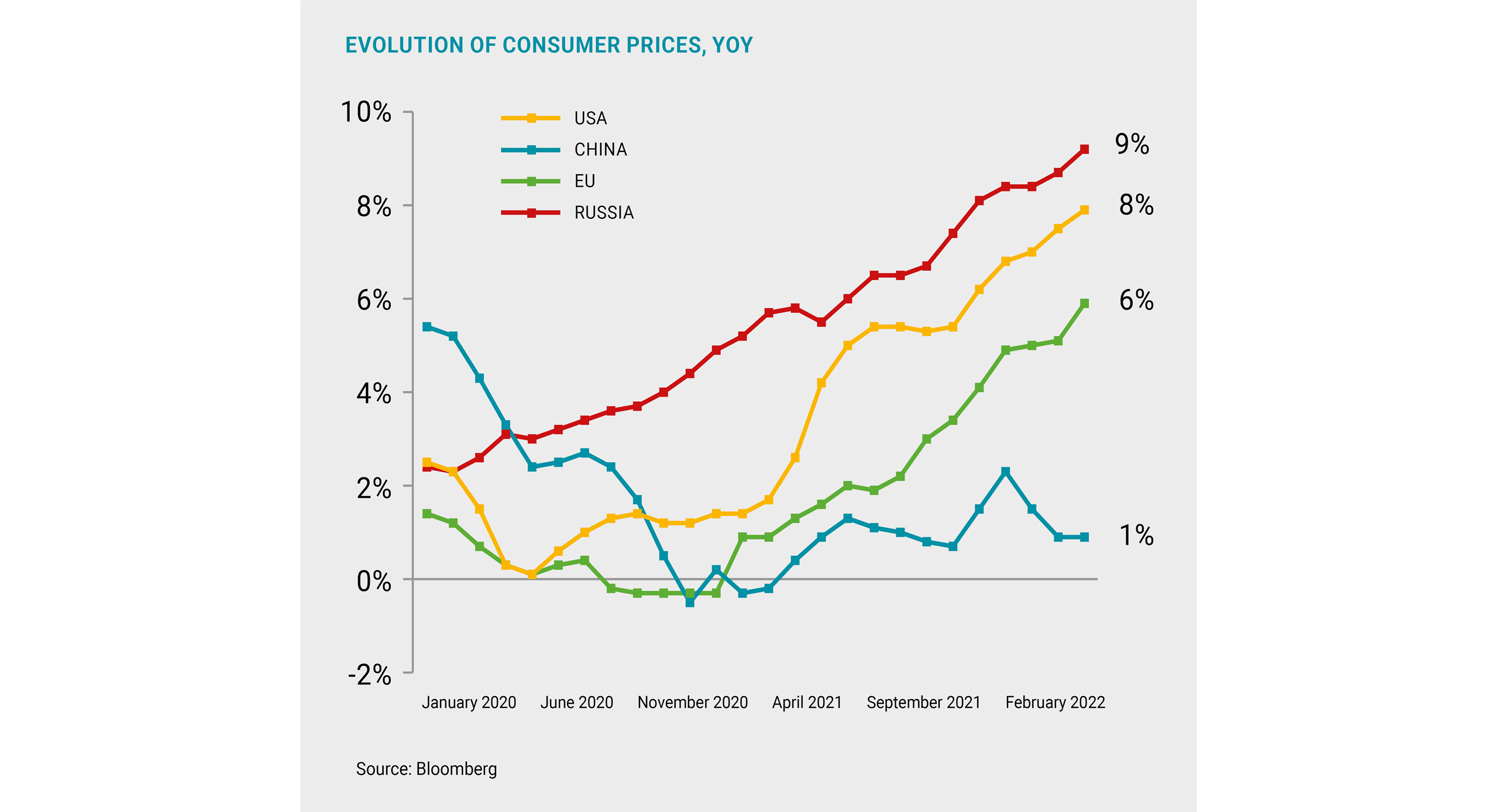

In March, year-on-year inflation in the United States and Europe rose to a record level in 30 - 40 years: 8.5% and 7.5%, respectively. Logistics constraints of both marine and land transportation are putting further upward pressure on prices. In various regions of the world, there is a shortage of railcars and excess inventory in storages and ports.

To tame inflation, the Federal Reserve and ECB plan to pursue a more aggressive monetary policy and key interest rate regulation. By the end of 2022, the US interest rate is projected to range between 2.25% and 2.5% rising from the current 0.25-0.5%.

TO TAME INFLATION, THE FEDERAL RESERVE AND ECB PLAN TO PURSUE A MORE AGGRESSIVE MONETARY POLICY AND KEY INTEREST RATE REGULATION

In China, where a new COVID-19 outbreak has been reported, the situation is different. Several large provinces and cities, including Shanghai with 26 million residents, remain under lockdown, causing limited economic activity and potential GDP decline vs the target growth rate of 5.5% in 2022. Against this background, inflation in China remains stable and the government is developing support measures to stimulate the economy, including increasing budget expenditure in 2022 by CNY 2 trillion (+8.4% YOY), and tax incentives.

Oil in deficit

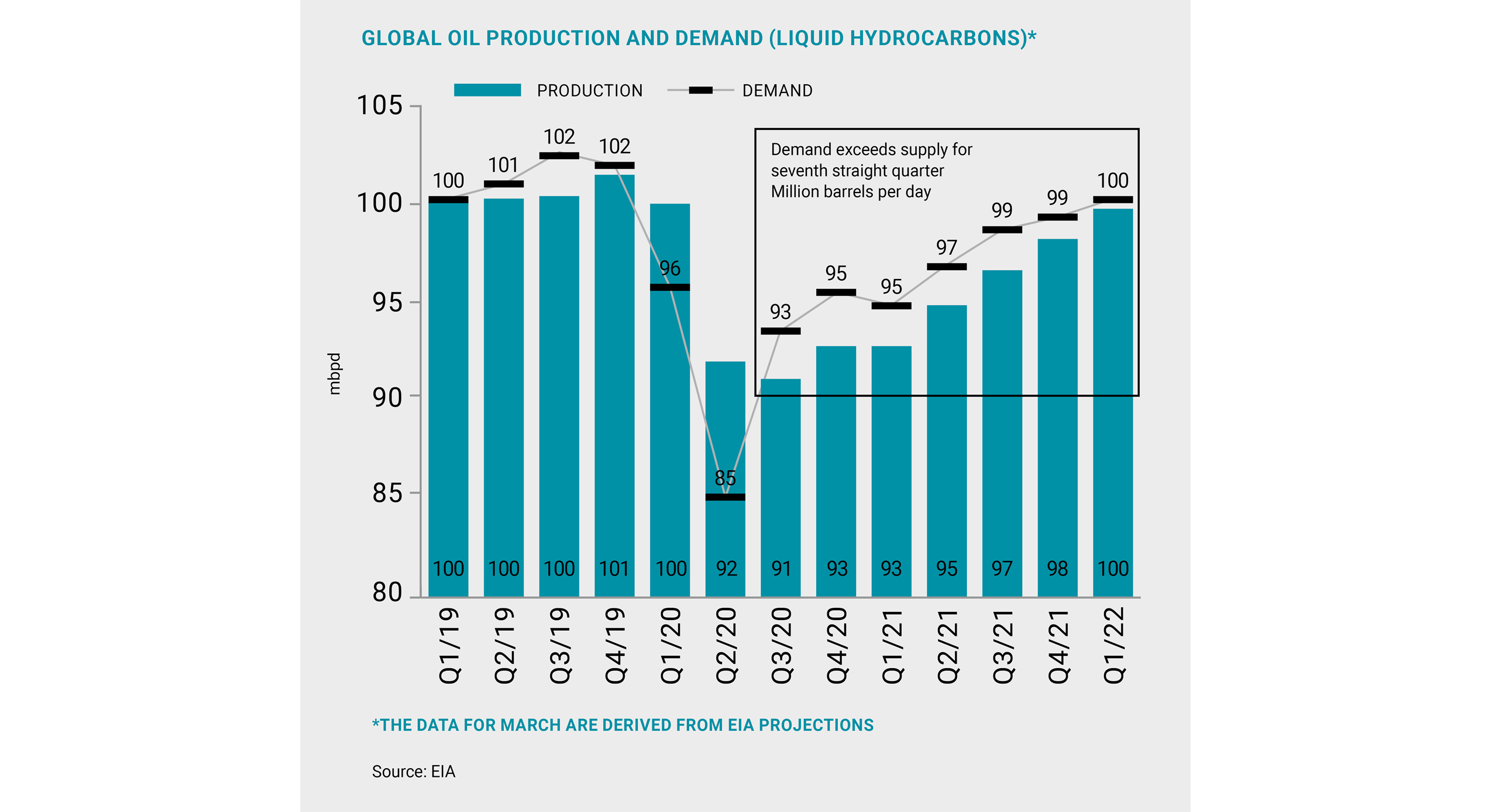

The global oil market has been experiencing a shortage of supply for the seventh straight quarter; however, in Q1 2022, it showed signs of abating. OPEC+ members continue to produce below the aggregate production quota by 1.1 million barrels per day, according to the latest estimates.

The sanctions put in place by the Western governments against the Russian financial system, commodity sector, and logistics pose an even greater threat to market security. In March, the export grades of Russian oil were trading at an unprecedented discount (up to USD 35/Bbl), and the estimated decline in oil production in Russia is projected at 1 - 3 million barrels per day over the next quarter. Brent surged to USD 138/Bbl after the US said it was considering a ban on Russian petroleum imports, while most analysts project the average price for 2022 to range between USD 100-120/Bbl.

IN MARCH, THE EXPORT GRADES OF RUSSIAN OIL WERE TRADING AT AN UNPRECEDENTED DISCOUNT (UP TO USD 35/BBL)

The potential for added oil supplies from Iran and supposedly Venezuela remains uncertain. Production in these two countries is expected to rise by an estimated 0.5 million barrels per day until the end of 2022. Still, releases from the strategic reserves of the US and its allies (180+ million barrels over the next six months) coupled with lower demand from China due to the lockdowns will help to temporarily stabilize the prices.

Margins in the petrochemical market go lower

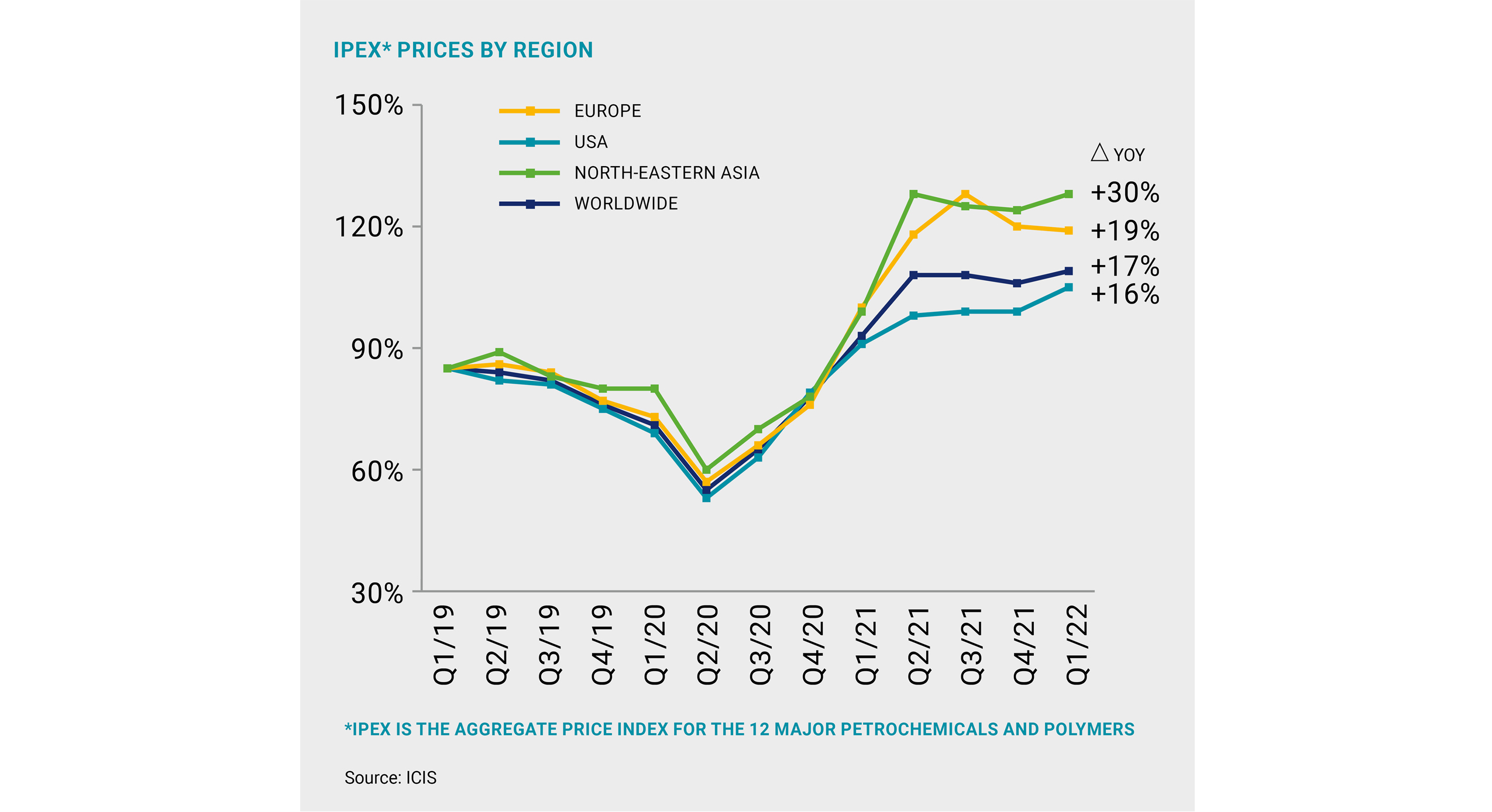

The ICIS Global Petrochemical Index (IPEX) rose by 3% quarter on quarter in Q1 2022, with the best dynamics reported in Asia (+6% QOQ). The petrochemical prices have been significantly affected by the rising feedstock prices along with continued logistics constraints. Yet, not all the producers managed to translate the higher feedstock prices into end product prices. In Q1 2022, most petrochemical chains reported falling margins owing to growing feedstock costs and downward-sloping product prices.

The Chinese market continues to operate under its own pricing framework, thus maintaining a major gap with the Western markets on a number of key petrochemical products. Due to logistics and balance factors, the petrochemical markets are now increasingly driven by regional trends. For example, the Chinese market is affected by the new COVID-19 outbreak that temporarily suppresses the demand. Still, prices remained stable amid new capacity additions and import decline. In January – February, China’s import of polyethylene (PE) and polypropylene (PP) dropped by 13% and 14%, respectively.

Divergent polymer prices

Polymer prices in the key regions were divergent. With the US seeing a decline, China and Europe were close to previous-quarter levels, which, combined with higher feedstock prices, resulted in lower margins. The most adversely affected was Asia where the average quarterly margins of integrated HDPE producers plunged below minus USD 300/tonne, similar to the Chinese case. For this very reason, numerous manufacturers lowered utilization rates from 10 to 30 p.p. or shut down production altogether.

Closures took place not only in China, but also in Japan, Taiwan, and South Korea. Even in Europe, there were occasional reductions of utilization rates while most producers were still running at positive margins.

IN Q1 2022, MOST PETROCHEMICAL CHAINS REPORTED FALLING MARGINS OWING TO GROWING FEEDSTOCK COSTS AND DOWNWARD-SLOPING PRODUCT PRICES

Another important trend is the continued decline of polymer imports to China, driven mainly by low prices in the region compared to the Western markets, high logistics costs and expansion of domestic capacity, despite a big number of unplanned shutdowns in the past quarter. Low margins do not stop the new producers from launching ‘unscripted’ capacities. The Chinese Zhejiang PC has started up a 400,000 tonnes HDPE production project. Zhongke refinery also launched a 100,000 tonnes LDPE/EVA unit and is producing EVA due to the fact that its price is higher compared to PE.

Polyethylene terephthalate (PETE) is one of the few large-tonnage petrochemicals that recorded a price growth in Europe and Asia, boosted by seasonal demand and rising production costs next to high energy prices. The PETE – TPA/MEG spreads in Europe and Asia hit a record high owing to rising PETE prices in parallel with declining MEG prices that dipped due to weak demand.

Rising cost of rubber production

The synthetic rubber market follows the same trends observed with other products: rising costs and lowering utilization rates. The major contributor to declining margins of rubber production was the price of butadiene both in Europe and Asia.

Butadiene supply remained limited due to poor economics of pyrolysis owing to rising feedstock prices, extremely high price of natural gas and electricity and yet modest price adjustments of olefins and their derivatives. The resultant utilization reductions shrank the supply of butadiene as a pyrolysis by-product.

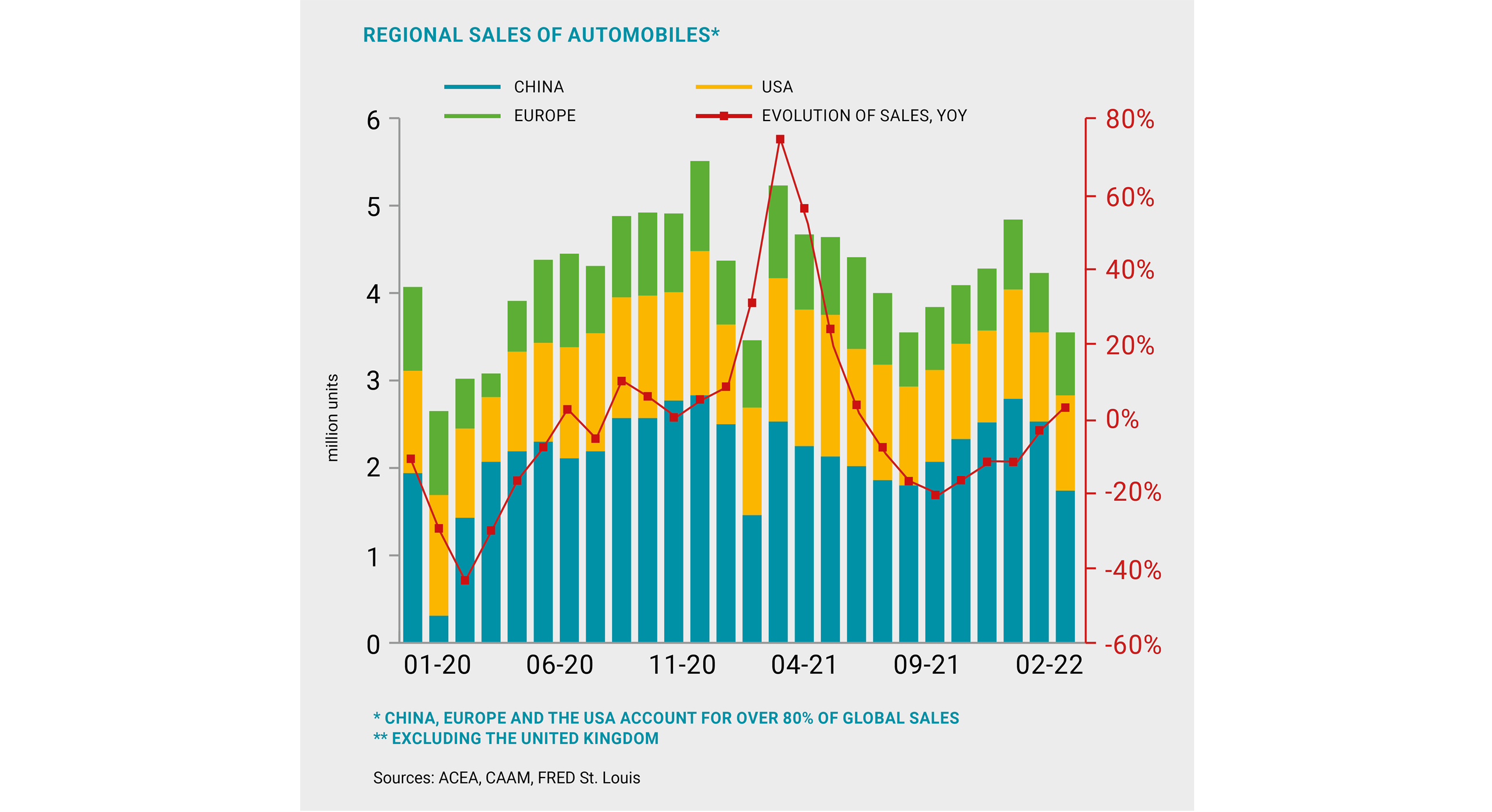

The market was further weighed down by concerns over declining pace of car sales due to parts shortage. In their 2022 forecast, IHS estimates the global light vehicle production at 81.6 million units, which corresponds to the 2021 figures. To compare: in the pre-disturbance years of 2018-2019, 90-94 million cars were produced annually.

Comments (0)